How Data Science is Revolutionizing Risk Management

In today’s fast-paced and complex world, the ability to manage risk effectively has become more critical than ever. Data science is at the forefront of this transformation, revolutionizing risk management by providing deeper insights, predictive capabilities, and more accurate assessments. Data4Risk, a leading platform specializing in risk data and analysis, utilizes advanced data science techniques to enhance risk management practices across various industries. This article delves into how data science is revolutionizing risk management and the role Data4Risk plays in this evolution.

Understanding Data Science in Risk Management

What is Data Science?

Data science is an interdisciplinary field that uses scientific methods, algorithms, and systems to extract knowledge and insights from structured and unstructured data. It involves processes such as data mining, machine learning, statistical analysis, and data visualization to uncover patterns and make data-driven decisions.

Data science is crucial in risk management as it allows organizations to analyze vast amounts of data quickly and accurately. By leveraging data science, companies can identify potential risks, predict future trends, and develop strategies to mitigate adverse outcomes. This not only enhances decision-making but also improves overall operational efficiency.

Key Techniques and Tools in Data Science for Risk Management

Predictive Analytics

Predictive analytics uses historical data and machine learning algorithms to predict future events. In risk management, predictive analytics can forecast potential risks, such as financial losses, natural disasters, or cybersecurity threats. Data4Risk employs predictive models to provide clients with proactive risk management strategies, showcasing how data science is revolutionizing risk management.

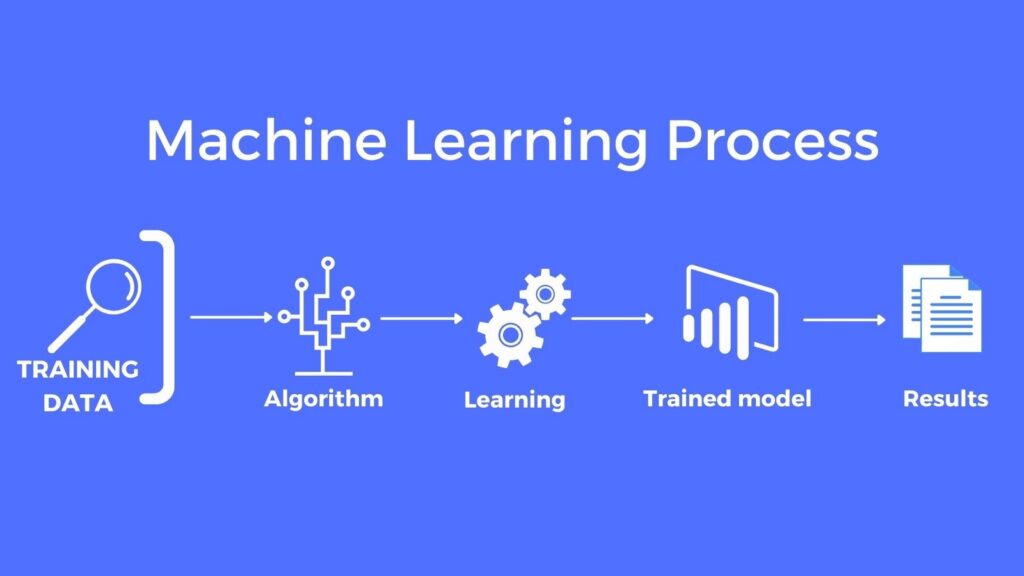

Machine Learning

Machine learning algorithms learn from data and improve over time. These algorithms can identify complex patterns and relationships within data that traditional methods might miss. Data4Risk uses machine learning to enhance risk assessments and develop sophisticated models for risk prediction. This is another example of how data science is revolutionizing risk management.

One of the key strengths of machine learning is its ability to learn and improve over time. As more data becomes available, machine learning models refine their predictions and adapt to new information, ensuring that risk assessments remain accurate and up-to-date.

Machine learning supports better decision-making by providing data-driven insights and recommendations. Risk managers can rely on these insights to make informed decisions, reducing uncertainty and improving risk management outcomes.

Big Data Analytics for Risk Insights

Big data analytics involves processing and analyzing large datasets to uncover insights and trends. In risk management, big data analytics helps organizations understand risk factors from various sources, such as social media, IoT devices, and transactional records. Data4Risk leverages big data to provide comprehensive risk analyses, highlighting the revolutionary impact of data science on risk management.

Data Visualization for Risk Analysis

Data visualization tools help in presenting complex data in a visual format, making it easier to understand and interpret. Effective data visualization aids in communicating risk insights to stakeholders clearly and concisely. Data4Risk uses advanced visualization techniques to present risk data in an actionable format, further illustrating how data science is revolutionizing risk management.

Applications of Data Science in Risk Management

Financial Risk Management with Data Science

Data science plays a crucial role in managing financial risks by analyzing market trends, credit scores, and economic indicators. Data4Risk helps financial institutions predict market volatility, assess credit risks, and develop strategies to minimize financial losses. This application demonstrates how data science is revolutionizing risk management in the financial sector.

Cybersecurity Risk Management through Data Science

With the increasing prevalence of cyber threats, managing cybersecurity risks has become a top priority for organizations worldwide. Data science is revolutionizing cybersecurity risk management by providing advanced tools and methodologies to detect, analyze, and mitigate cyber threats more effectively. Data4Risk leverages data science to enhance cybersecurity risk management, helping organizations safeguard their digital assets and maintain operational integrity.

Data science enables the detection of cyber threats through the analysis of large volumes of data from various sources. Machine learning algorithms can identify patterns and anomalies that may indicate potential security breaches. By continuously monitoring network traffic, user behavior, and system logs, data science tools can detect suspicious activities in real time.

Operational Risk Management Using Data Science

Operational risks arise from internal processes, people, and systems. Data4Risk employs data science techniques to analyze operational data, identify inefficiencies, and recommend improvements. This enhances process efficiency and reduces the likelihood of operational disruptions, underscoring how data science is revolutionizing risk management.

Environmental Risk Management with Data Science

Environmental risks, such as natural disasters and climate change, pose significant challenges to organizations. Data4Risk uses data science to analyze environmental data, predict weather patterns, and assess the impact of environmental risks. This helps organizations develop robust disaster recovery plans and highlights how data science is revolutionizing risk management.

How Data4Risk Leverages Data Science for Superior Risk Insights

Comprehensive Data Collection for Risk Management

Data4Risk collects data from a wide range of sources, including public records, satellite imagery, and IoT sensors. This comprehensive data collection ensures that risk assessments are based on accurate and up-to-date information. This approach is a prime example of how data science is revolutionizing risk management.

Advanced Analytical Techniques in Risk Analysis

Data4Risk employs advanced analytical techniques, such as machine learning, neural networks, and natural language processing, to analyze complex datasets. These techniques uncover hidden patterns and provide deeper insights into potential risks. This advanced analysis highlights how data science is revolutionizing risk management.

Customized Risk Solutions by Data4Risk

Data4Risk offers tailored solutions to meet the specific needs of each client. Whether it’s financial risk, cybersecurity, operational, or environmental risk, Data4Risk provides targeted analysis and actionable recommendations. This customization further emphasizes how data science is revolutionizing risk management.

Data4Risk provides real-time risk monitoring services, enabling clients to stay informed about potential risks as they emerge. This proactive approach allows organizations to respond swiftly to mitigate adverse impacts, illustrating how data science is revolutionizing risk management.

The Future of Data Science in Risk Management

Integration of Artificial Intelligence in Risk Management

AI-powered systems can analyze vast amounts of data at unprecedented speeds, providing real-time risk assessments and automated responses. This future trend will continue to show how data science is revolutionizing risk management.

One of the key benefits of integrating AI into risk management is the improvement in predictive accuracy. AI algorithms can process and analyze historical data to identify patterns and trends that might be indicative of future risks. These predictive models become more accurate over time as they learn from new data, allowing organizations to anticipate and prepare for potential risks more effectively.

AI enables real-time risk monitoring by continuously analyzing data from various sources. This real-time capability allows organizations to detect emerging risks as they happen and respond swiftly. For instance, AI can monitor financial markets, social media, news outlets, and other data streams to identify potential threats such as economic downturns, reputational damage, or cybersecurity breaches.

Enhanced Predictive Capabilities in Risk Analysis

Future advancements in predictive analytics will enable more accurate risk predictions. Data4Risk is at the forefront of developing cutting-edge predictive models that can foresee risks with greater precision, further proving how data science is changing risk management.

Greater Focus on Data Privacy

As data science continues to evolve, ensuring data privacy and security will become increasingly important. Data4Risk is committed to maintaining the highest standards of data privacy and implementing robust security measures to protect client data.

Conclusion

Data science is revolutionizing risk management by providing deeper insights, predictive capabilities, and more accurate assessments. Data4Risk leverages advanced data science techniques to offer superior risk insights and customized solutions to clients. By embracing the power of data science, organizations can enhance their risk management practices, mitigate potential risks, and achieve greater operational efficiency. The future of risk management lies in the continued integration of data science and technology, ensuring that organizations are well-equipped to navigate an increasingly complex risk landscape.