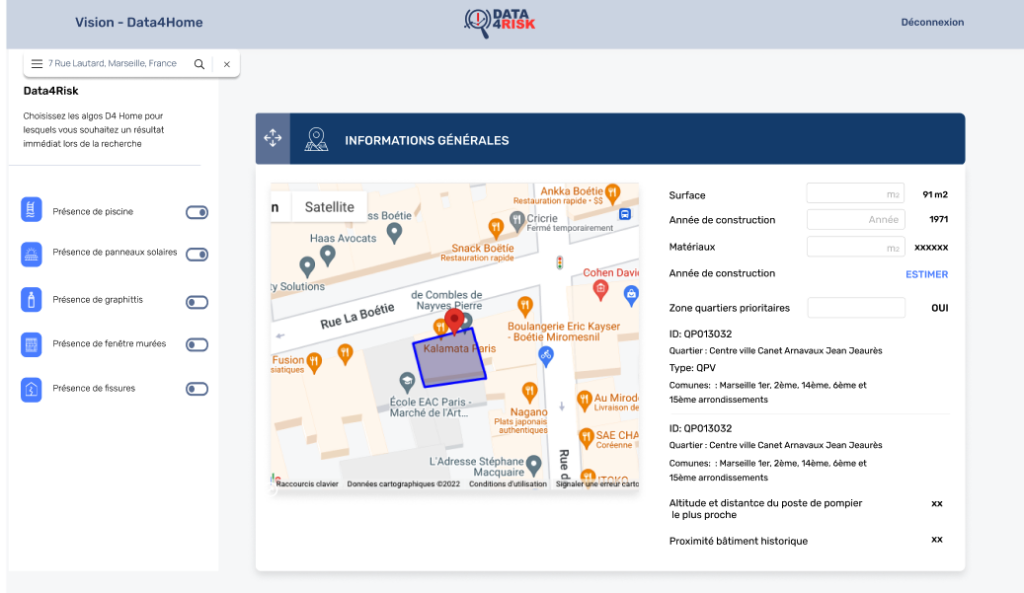

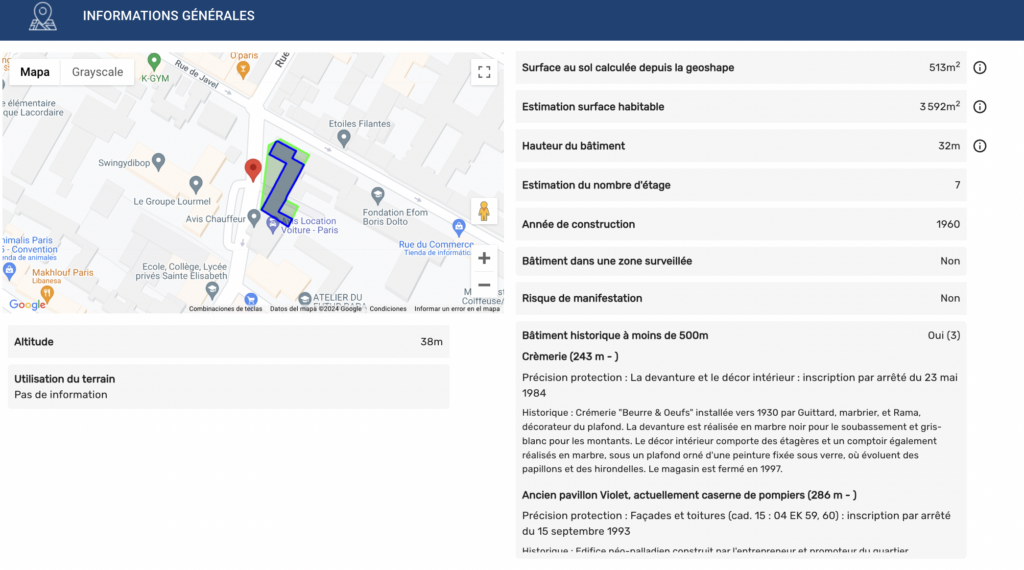

Data4Home harnesses AI-based technology and advanced data analytics to revolutionize the assessment and management of insurance risks for residential properties. Our sophisticated tools enable you to make informed decisions, mitigate hazards, protect investments, and streamline the insurance subscription process.